Daily Paper

Top Stories

Home Run Derby

(CBS) Seattle's Cal Raleigh wins 2025 Home Run DerbySeattle's Cal Raleigh won his first All-Star Home Run Derby after leading the big leagues in long balls going into the break, defeating Tampa Bay's Junior Caminero 18-15 in the final round.

Jalen Hurts

(FOX) Eagles' Nick Sirianni blasts 'bulls---' narratives around Super Bowl champ Jalen HurtsPhiladelphia Eagles head coach Nick Sirianni slammed "bulls---" narratives around star quarterback Jalen Hurts after he won a Super Bowl in February.

Garrett Wilson

(FOX) Jets, Garrett Wilson agree to massive contract extension: reportsThe New York Jets and wide receiver Garrett Wilson reportedly agreed to a massive four-year contract extension on Monday after a career year.

Cal Raleigh

(FOX) Cal Raleigh victorious in 2025 Home Run Derby, becomes 1st catcher ever to win in thrilling fashionCal Raleigh, MLB's home run leader at the All-Star break, became the first catcher ever, and the second Seattle Mariners player, to win the Home Run Derby on Monday night.

Nick Saban Coaching

(FOX) Nick Saban return rumors run rampant during SEC Media DaysRumors about Alabama Crimson Tide legend Nick Saban returning to the coaching ranks ramped up on Monday during the first day of SEC Media Days.

Business

Japanese Bond Yields

(CNBC) Japan bond yields hit multi-decade highs as fiscal fears mount ahead of electionJapan's benchmark 10-year government bond yield climbed to its highest level since 2008 ahead of an upper house election.

Weak Dollar

(DOW) Plunging Dollar Leaves American Travelers With Less Buying Power This SummerThe U.S. dollar’s first-half decline against peer currencies was its steepest in more than 50 years.

ESG Investing

(DOW) Opinion | How to Evaluate the Efficacy of ESG InvestingJames Mackintosh points to a chicken-or-egg question in writing that the data hasn’t improved portfolio performance.

Financial Stocks

(DOW) Financial Stocks Rise Ahead of Busy Week for Earnings, Inflation DataJPMorgan, Wells Fargo lead the banks whose quarterly results may offer clues on how consumers and companies fared during a volatile period. The S&P 500 climbed 0.1%, and the Nasdaq rose 0.3% to a record.

IPO

(DOW) PE-Backed McGraw Hill, NIQ Global Intelligence Unveil IPO TermsEducation publisher McGraw Hill and consumer-intelligence provider NIQ Global Intelligence have unveiled terms of planned initial public offerings that could give each of the private equity-backed companies a multibillion-dollar market capitalization.

Sports

Home Run Derby

(ESPN) Takeaways from the Home Run Derby in Atlanta(CBS) Where to watch MLB Home Run Derby: TV channel, live stream, odds, prediction, participants, start time

(FOX) 2025 Home Run Derby Highlights: Cal Raleigh Beats Junior Caminero in Finals

We have your one-stop shop for the most power-packed day of the baseball year.

Big 12

(CBS) Big 12's revenue-sharing distribution deal with PayPal includes expanded financial partnershipThe Big 12 will receive nearly nine figures over the next five years, and expand branding

Basketball in Europe

(CBS) Timberwolves' Donte DiVincenzo hopeful to play for Italy at FIBA EuroBasket after gaining citizenshipMinnesota's guard previously tried to receive citizenship for the 2024 Paris Olympics

Raiders Roster Moves

(PFT) Raiders waive QB Carter BradleyThe Raiders did a little pre-training camp roster trimming on Monday.

INDYCAR Power Rankings

(FOX) INDYCAR Power Rankings: Iowa Winners Alex Palou, Pato O'Ward No. 1 & 2Pato O'Ward surged up the rankings after a solid weekend at Iowa, but was it enough to dethrone Alex Palou?

Entertainment

Beyoncé Music

(USMag) Beyonce's Unreleased Music Stolen From Choreographer’s Car in AtlantaPolice in Atlanta are working hard to track down thieves who allegedly stole unreleased music from Beyoncé out of her choreographer’s car this weekend. On Monday, July 14, WSB-TV 2 Atlanta reported that Beyoncé’s choreographer Christopher Grant and one of her dancers, Diandre Blue, told authorities thieves broke into the pair’s SUV and stole several […]

90 Day Fiance

(USMag) 90 Day Fiance’s Eric Rosenbrook Cited for OWI Days After Baby’s Death90 Day Fiancé alum Eric Rosenbrook is facing new legal trouble only days after he and his wife Leida Margaretha’s newborn baby, daughter Alisa, died, Us Weekly can exclusively report. On Monday, July 14, Rosenbrook had two citations filed against him in court: operating while under the influence and possessing an open intoxicant in a […]

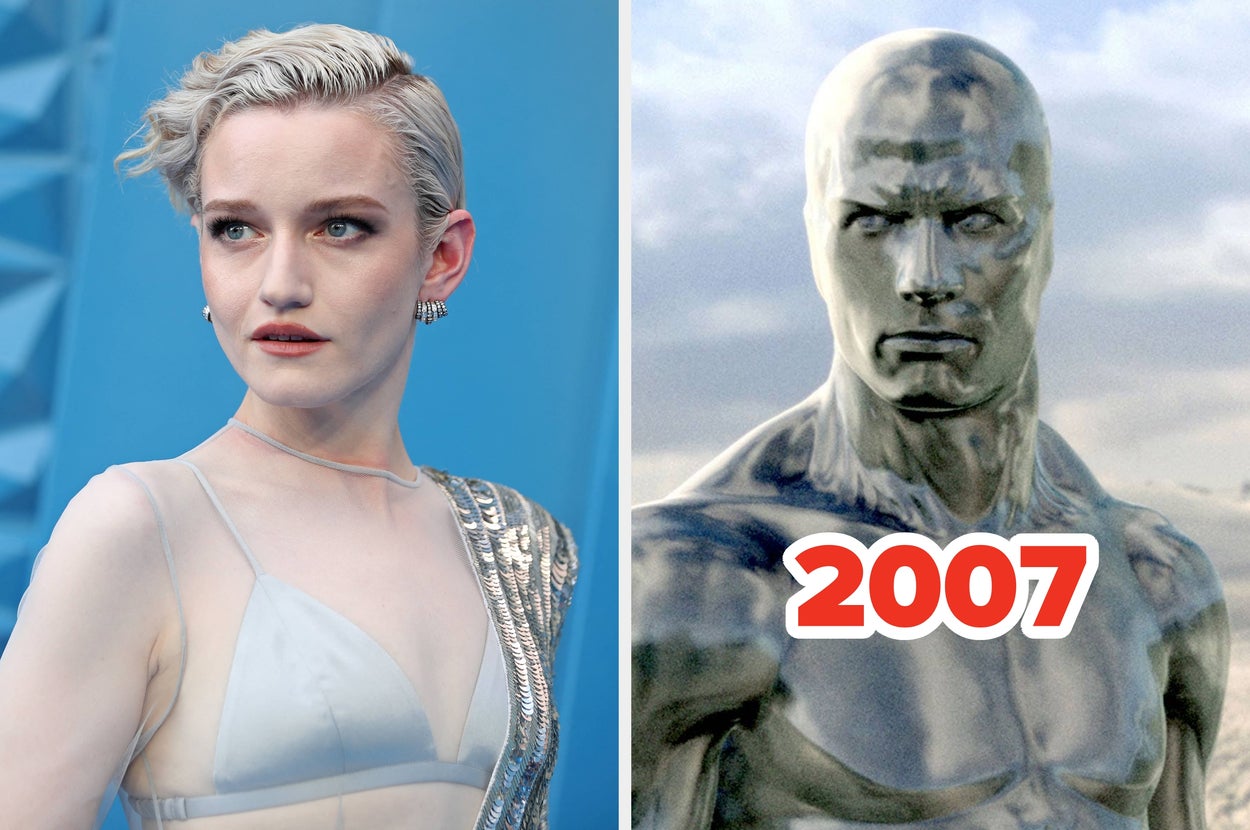

Fantastic Four

(BuzzFeed) After Her Casting Sparked Backlash, Julia Garner Responded To Criticism Over The Gender-Swapped Silver Surfer In “The Fantastic Four: First Steps”“It’s Shalla-Bal, so it’s different.”

Roseanne Barr

(BuzzFeed) John Goodman Revealed How Long It's Been Since He's Spoken To Roseanne Barr, And It's Genuinely ShockingThe actor played Barr’s husband on "Roseanne" and the follow-up show “The Conners.”

Friends With Benefits

(USMag) Dyan Cannon, 88, Steps Out After Revealing She Has 'Friends With Benefits'Dyan Cannon stepped out in style for a rare public appearance in West Hollywood. The actress, 88, was photographed walking her two dogs on Sunday, July 13, wearing a white top with a black overshirt, black pants, sandals and a black fedora. The outing came just a few months after Cannon opened up about her […]

Technology

Claude AI

(TechRadar) You don’t have to explain everything to Claude anymore – it’s finally in your appsAnthropic has upgraded Claude with new app integrations that let it work directly within popular tools.

iPhone Fold

(9to5) iPhone Fold is coming: Five new features for next year’s launch

Following years in development and countless rumors, Apple’s first foldable iPhone looks to finally be coming next year. Here are five new features rumored for Apple’s first ever iPhone Fold.

more…Secure Boot

(Bleeping) Gigabyte motherboards vulnerable to UEFI malware bypassing Secure BootDozens of Gigabyte motherboard models run on UEFI firmware vulnerable to security issues that allow planting bootkit malware that is invisible to the operating system and can survive reinstalls. [...]

Harry Potter

(TechRadar) HBO’s Harry Potter TV show begins production, and one first-look costume is already spot-onWe’ve got our first look at the next Harry Potter as HBO starts production on its upcoming TV show, and it’s everything you want it to be.

iOS 18 Beta

(9to5) iOS 18.6 beta 3 and more available now, here’s what to expect

Apple has just released a batch of new betas for the current iOS 18 software cycle: iOS 18.6 and more have received beta 3 updates.

more…